The Role of Financial Education

Financial education performs a pivotal position in Bankruptcy Recovery. Understanding the fundamentals of budgeting, saving, and investments can empower individuals to make informed choices. Educational sources can range from on-line courses to neighborhood workshops, all aimed at enhancing one’s monetary liter

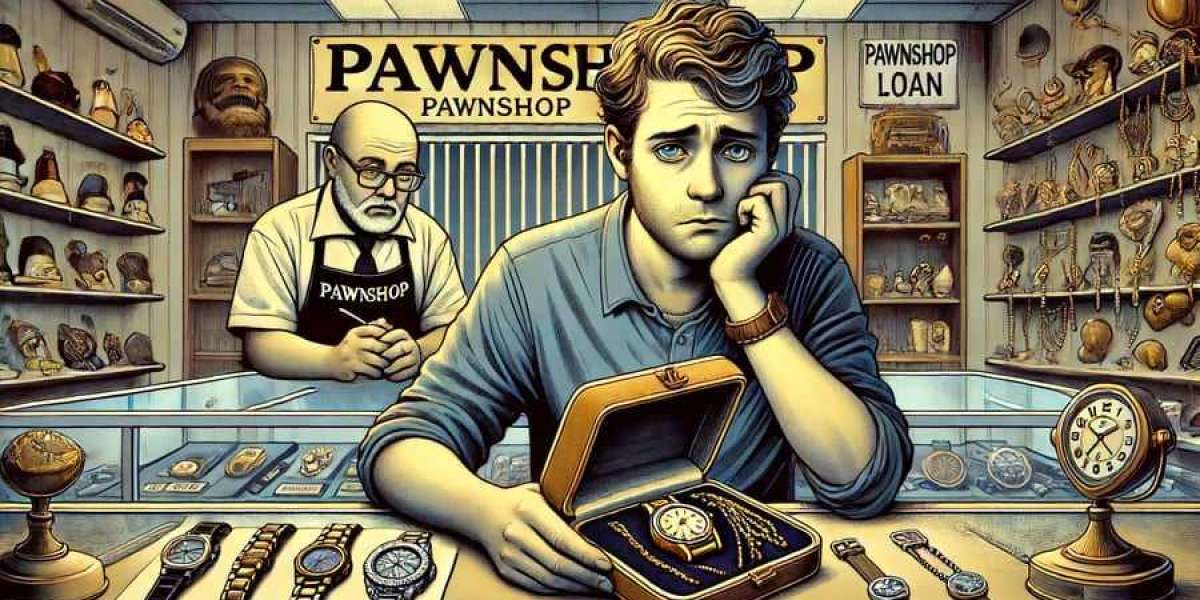

Understanding Day Laborer Loans

Day Laborer Loans are particularly designed for people who work on a day-to-day basis, typically without a secure income. These loans cater to the monetary needs of staff who could require instant money for unexpected bills, personal emergencies, or to cowl living costs in periods of unemployment. The application course of is typically straightforward, requiring minimal documentation in comparison with traditional loans, making it simpler for day laborers to amass funds shortly. However, it is essential to understand the terms and circumstances linked to these loans to avoid potential pitfalls, such as high-interest charges or unfavorable repayment te

Day Laborer Loans could be safe if borrowed responsibly. It is essential to understand the terms of the loan, together with rates of interest and repayment durations. Choosing a good lender and making certain that the mortgage aligns together with your monetary scenario can mitigate risks associated with borrow

Maintaining open communication with lenders is key. Should circumstances arise that make repayment tough, reaching out to discuss choices before falling behind can prevent detrimental results on credit score scores and assist negotiate alternative preparati

One of the excellent options of BePick is its user-friendly interface, permitting people to compare numerous mortgage choices side by side. This transparency empowers debtors to make educated decisions, ultimately main to higher financial outco

Moreover, a proactive approach in sustaining or regaining credit score ratings is crucial during the restoration phase. Regularly checking credit stories for inaccuracies and focusing on well timed payments are efficient strategies that may considerably enhance one’s credit score score over t

Furthermore, customers ought to understand that calculators provide estimates. They are not substitutes for skilled financial advice or formal loan phrases. Any decision should ultimately involve session with financial experts to validate the assumptions made with calculator outp

Where to Find Reliable Information

As a day laborer looking for Pawnshop Loan options, one of the biggest challenges may be discovering reliable information. Websites like 베픽 function a comprehensive useful resource for info on Day Laborer Loans. They provide detailed articles, consumer critiques, and professional insights into numerous lending choices available out there. By using such platforms, laborers can evaluate different loans, understand the benefits and drawbacks, and make better-informed financial selecti

In today's uncertain financial surroundings, accessing funds throughout unexpected emergencies is often a lifeline for many individuals and families. Emergency fund loans function a important safety internet, offering fast financial help when it’s wanted most. This article explores the idea of emergency fund loans, how they work, their benefits, and why web sites like BePick are important sources for people seeking data and evaluations on these financial merchandise. It's crucial to know the implications and options available, making certain one makes informed selections in instances of disas

Tips for Responsible Borrowing

To successfully handle Day Laborer Loans, borrowers ought to adhere to several monetary best practices. First, it’s important to borrow only what you'll be able to afford to repay, minimizing the risk of falling into debt. Secondly, maintaining a budget helps observe revenue and bills, guaranteeing that Monthly Payment Loan repayments are prioritized. Lastly, utilizing assets like 베픽 can provide ongoing assist and data, serving to laborers stay informed about their choices and making better monetary choi

BePyck aims to demystify the borrowing course of, equipping customers with the instruments they should navigate their financial pathways confidently. Beyond calculators, the platform’s wide-ranging content caters to those in any respect ranges of monetary literacy, ultimately selling smarter borrowing practi

The first step in restoration is to know the kind of chapter filed—either Chapter 7 or Chapter thirteen. Chapter 7 entails liquidating assets to repay creditors, whereas Chapter 13 allows people to create a repayment plan to settle their debts over a specified period. Each option has its distinctive implications for restoration, influencing how shortly one can rebound financia

Moreover, understanding the mechanics of those Other Loans helps debtors appreciate their position in private finance administration. An emergency fund is commonly thought of a fundamental side of monetary planning, enabling individuals to handle urgent wants without resorting to high-interest credit cards or payday lo

germanc1956563

36 Blog posts